Simple, cloud-based payroll software that delivers everything you need to pay your people on time, and free from errors.

Integrated payroll software

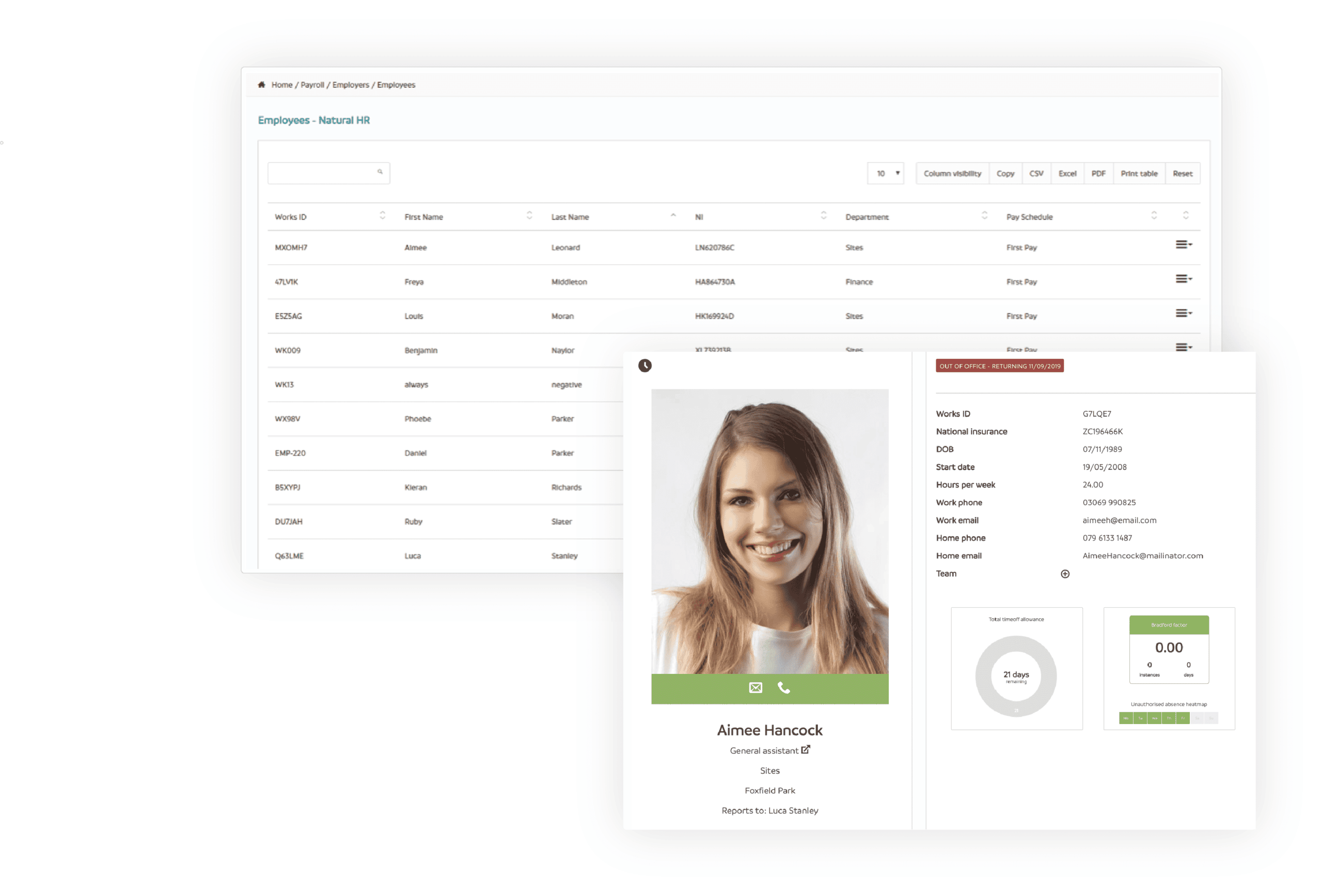

Manage and pay your employees from one system

Providing a single view of your entire workforce, Natural HR makes it easy to engage, manage and pay your people.

- Oversee and manage your HR and payroll departments from one system

- Store employee information and payroll data in one secure system

- Minimise costly mistakes in pay and manage salary changes, bonuses, new starters and much more from one fully integrated system

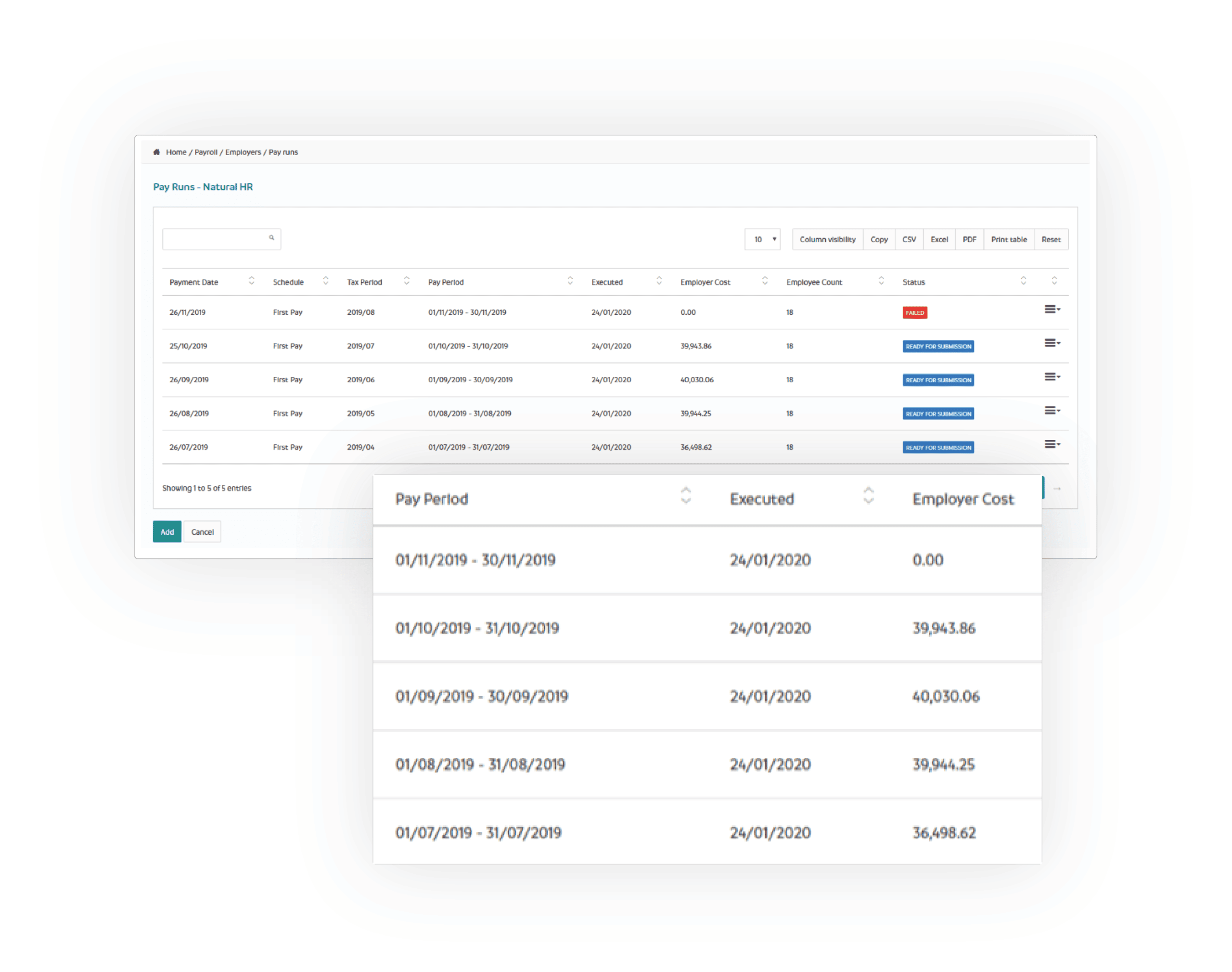

Fully compliant payroll

Ensure complete compliance with the latest legislation

Minimise any risk of non-compliance with payroll software that meets HMRC standards and all the latest legislation.

- All mandatory documents are produced and sent to HMRC automatically

- Set up and issue payment instructions for both your employees and HMRC with ease

- Your data is stored in highly secure UK data centres to the highest GDPR compliant standards

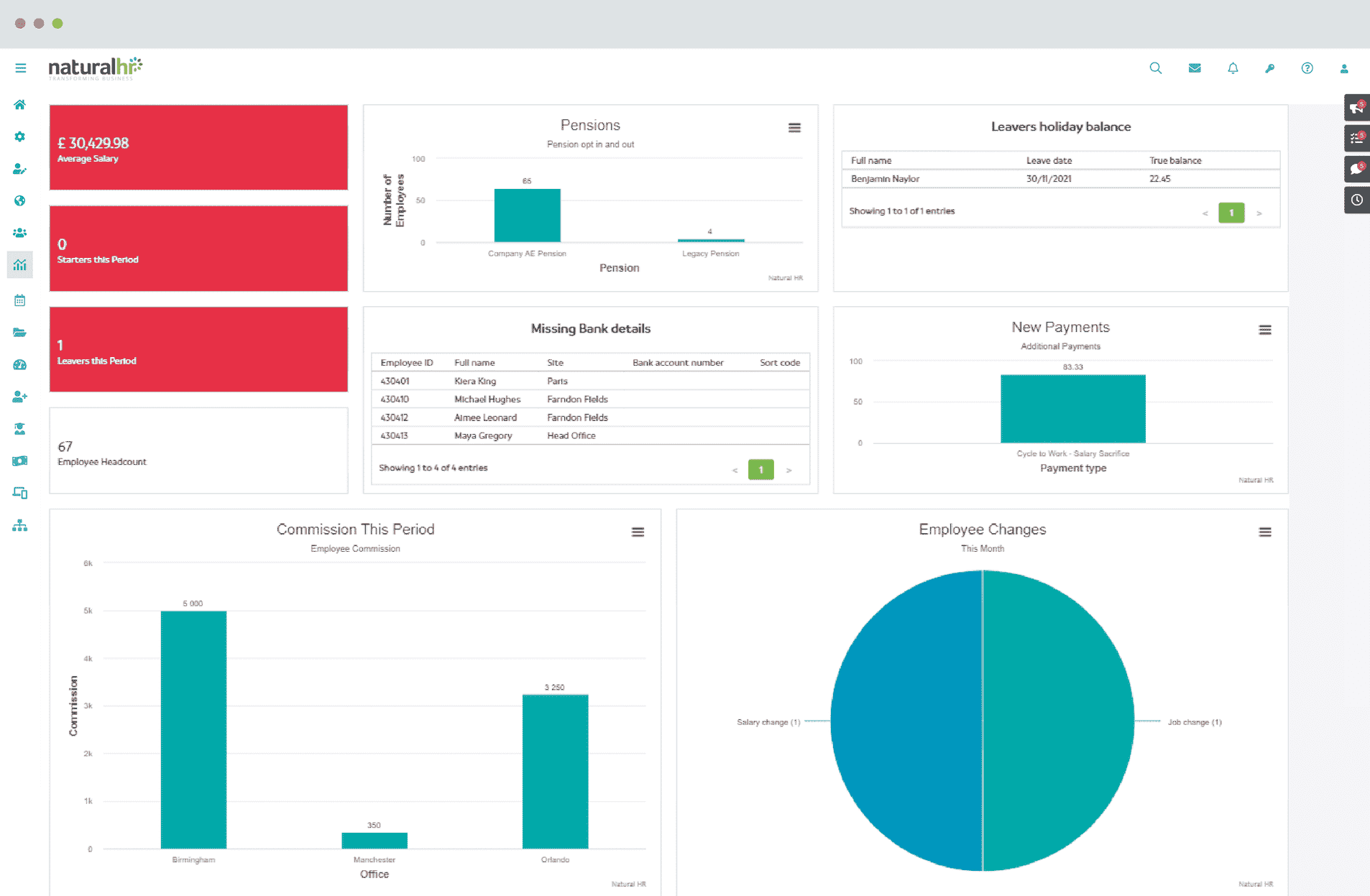

Powerful analytics

Get fast insights into trends within your business

Our real-time analytics engine means you can see what’s happening in your business at a glance.

- Use our pre-defined payroll reports or create custom ones to track and monitor each pay run

- Track and report on changes in salary and bonuses over time

- Deliver payroll reports as easy-to-consume dashboards, charts and graphs

Simple payroll management

01. Better support your people

Natural HR delivers everything you need to support your people so that they can thrive and better contribute to productivity and business growth.

Information that’s always up to date

02. One single system for all your HR and payroll needs

Manage, engage and pay your people from one single, integrated system rather than across disparate software or spreadsheets.

Reliable payroll software

03. Pay your people correctly first time, every time

Natural HR’s fully integrated HR and payroll software makes costly mistakes in pay a thing of the past with one single system to manage and pay your employees.

Accreditations

Payroll FAQs

What is an integrated payroll system?

An integrated HR payroll system is a software solution that merges payroll and HR activities for maximum efficiency.

By integrating all of your workforce management activities into one platform, you can gain benefits like removing Excel spreadsheets and dealing with multiple data silos, reducing the amount of work your HR and payroll teams need to undertake.

How does integrated payroll software help with compliance?

The most significant advantage to integrating your payroll is that your HR and payroll software will be integrated into one system. Likewise, there will now only be one point of entry that can be tracked for compliance and security purposes.

The integration allows you to provide audits when necessary, make changes, such as when the National Minimum Wage (NMW) is increased and view outgoing with integration into reporting and analytics modules.

What are minimum pension contributions?

The minimum total contributions under automatic workplace enrolment have been set at a contribution rate of 8% for most people. An employer must contribute a minimum amount, and in most cases, this is 3%. The minimum total contribution for an employee is usually based on what’s known as ‘qualifying earnings.’

Does redundancy pay go through payroll?

As with your regular business payments, when dealing with redundancy pay, you should deal with the tax and NIC due on any taxable parts of your redundancy package under the Pay As You Earn (PAYE) system. Still, the exact treatment, and any action you need to take, will depend on the timing of the payment.

When are the 2022 UK bank holidays?

These are the official 2022 Bank holiday dates in England and Wales.

- 3 January – New Year’s Day (substitute day)

- 15 April – Good Friday

- 18 April – Easter Monday

- 2 May – Early May bank holiday

- 2 June – Spring bank holiday

- 3 June – Platinum Jubilee bank holiday

- 29 August – Summer bank holiday

- 26 December – Monday Boxing Day

- 27 December – Christmas Day (substitute day)

What are the student and postgraduate loan repayments deductions?

Student loan repayment is currently at the following rates:

- 9% of their income above £19,895 a year for Plan 1

- 9% of their income above £27,295 a year for Plan 2

- 9% of their income above £25,000 a year for Plan 4

- 6% of their income above £21,000 a year for Postgraduate loans