Gain complete control over expenses and mileage – claims can be easily uploaded and approved with the click of a button.

Join thousands of customers using Natural HR for their expense management and mileage today

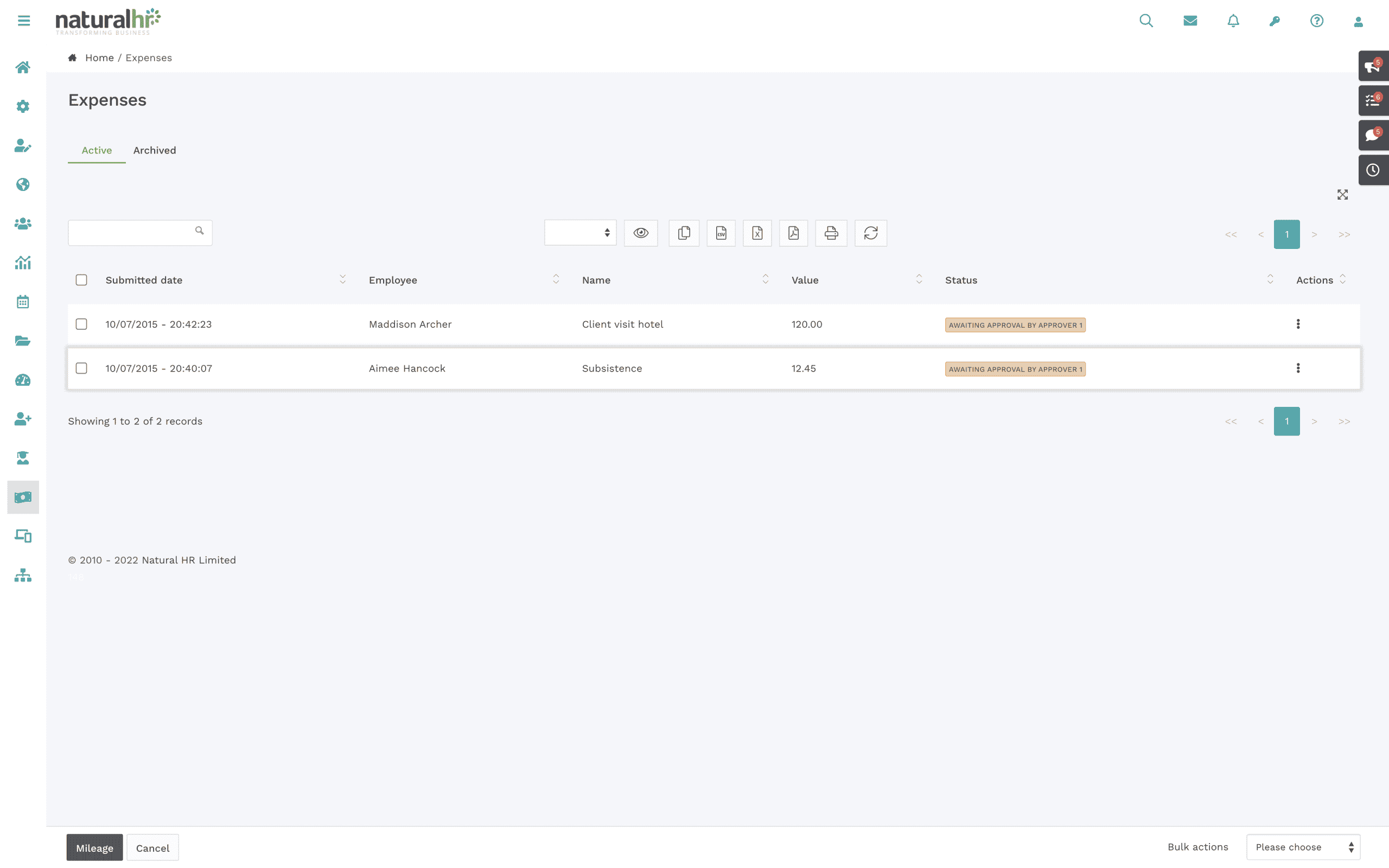

Simple expense claims

Submit, approve and report on expense claims with ease

Allow your team to submit claims, upload supporting receipts and submit for approval in a few simple clicks, while managers can view and approve them at the touch of a button.

- Employees can submit expenses from anywhere, at any time – even on their smartphone

- Empower managers to approve, reject, push back on or add comments to claims

- Automated emails can notify both the employee and their approver of a new claim and its status

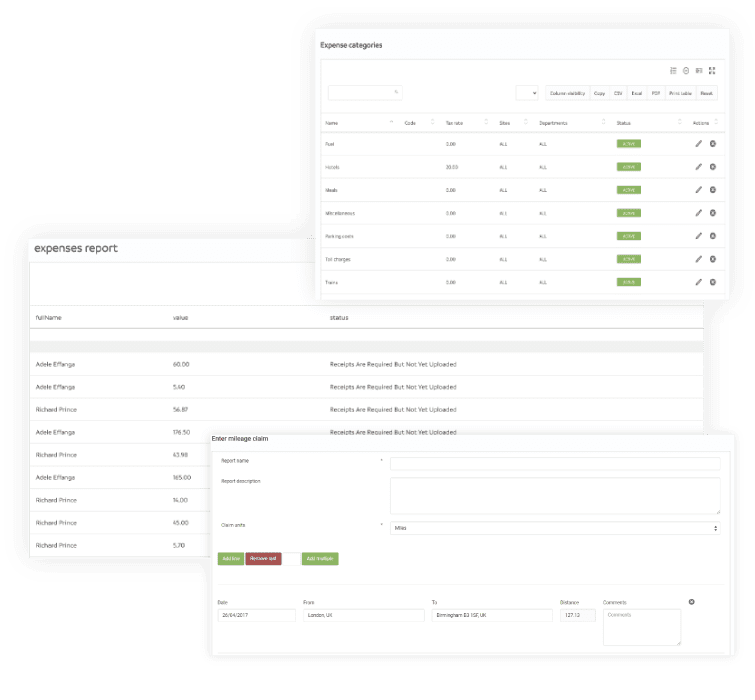

Expenses and mileage reporting

Keep track of expense and mileage claims

Create in-depth reports to monitor expense and mileage claims by department, site and per employee so you can keep track of the value of expense claims submitted.

- Create custom reports to visualise all employee expense and mileage claims

- Track the value of claims by category such as hotels, travel, subsistence, entertainment, stationary and more

- Get complete control and visibility into company expenditure

Accurate expense management

Safeguard your company from errors in claims

Minimise any mistakes in expense claims and exaggerated or falsified costs with an easy-to-use submission process, clear claim procedure and automated notifications.

- Create custom declarations that prompt employees to confirm the accuracy of their expense claims

- Set an upper limit for expense claims that notify you whenever costs breach this limit or are out of policy

- Google address lookup allows for more accurate mileage requests

Save your employees time

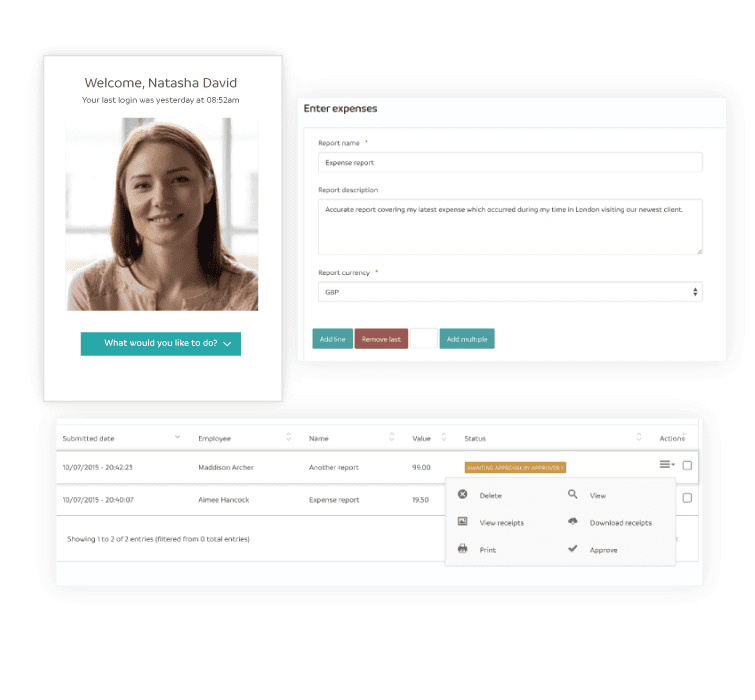

01. Simplify expense requests

Make it easy for your employees to submit expense and mileage claims, upload receipts and track the status of their claims.

Go paperless

02. Online expense management

Bring all of your expense and mileage claims online with our clear, secure modules that means printed requests and paper forms are a thing of the past.

Improve management visibility

03. Manage expense claims

Easily generate reports that answer key questions such as how much has been spent with a specific vendor and which department or individual has had the highest value claims.

Expenses & Mileage FAQs

What is expense and mileage management?

Expense management is the processes HR has in place for the submission, approval and paying of improved employee expenses such as business-related travel, fuel or accommodation costs when on business-related works. The management aspect includes the policy governing the process and the systems involved in processing all relevant data.

Is the mileage rate for Electric Cars different to standard cars?

For your employees who have petrol, diesel or hybrid cars, the UK’s Millage Allowance Payments allow you to claim 45p per mile for the first 10,000 business miles in the financial year and 25p per mile after that. If you have an electric car as a company car, the advised pay rate is 4p per mile.

Check an employer make deductions from the wages of your staff?

As an employer, you can only make a deduction from the pay of your staff if, between both parties, one of the following conditions is met: The employee contract explicitly allows the deduction, it was agreed in writing beforehand, you’ve overpaid the staff member by mistake, it’s required by law, for example, by a court order or you missed work because you were on strike or taking industrial action.

How can you control expenses in a business?

The best way to control business expenses is to manage them within your business actively. Using your HR platforms reporting and expenses module, you will be able to diligently track expenses and see the entire lifecycle of requests, payments and costs. It’s also vital to ensure you have a workplace policy in place that clearly states what’s an expense, any limits on claims, as well as providing an integrated approach with your payroll module so that staff can get paid promptly.

Can you claim milage and car expenses if you're classed as self-employed?

If you are self-employed then you can claim allowable business expenses for:

- Vehicle insurance

- Repairs and servicing

- Fuel

- Parking

- Hire charges

- Vehicle licence fees

- Breakdown cover

- Train, bus, air and taxi fares

- Hotel rooms

- Meals on overnight business trips

Does driving to work count as a business mileage?

Business mileage refers to journeys you undertake in the course of your work, with the exception of your regular commute. HMRC guidelines define travel between your home and your regular, permanent place of employment as a non-work journey, making it ineligible to be included as part of your business mileage claim.